Modern IT systems drive digitisation in the insurance industry

The insurance industry is in the midst of a digital transformation.

Increasingly, customers expect comprehensive digital services around policy management. The need to digitally connect sales partners, coupled with escalating cost pressures due to a low-interest phase, are leading to a conflict of goals in the insurance industry in terms of long-term IT development. Modern, powerful IT is a prerequisite for the future viability of insurers, as well as a high cost factor.

Maximise your opportunities

At the same time, process automation is opening up numerous opportunities to take advantage of growth, as it increases productivity and customer satisfaction while meeting regulatory requirements.

To achieve this, it is necessary to transform the often confusing system landscape characterised by silos. This transformation, or the replacement of the siloed system landscapes, represents a risk for companies, and requires corresponding investments. Dynamically modifiable and expandable IT systems represent an important basis of existence for insurance companies, so it is important to select these IT systems with great care. In this context, following the digitisation of front ends, the adaptation of the “rigid” back ends is imperative as a second wave of transformation, since outdated back-end systems may represent significant disadvantages in new competitive environments; as they are hardly capable of being adapted to the necessary product-specific, customer-specific and regulatory requirements.

Modernise your core system

To meet these challenges, more companies are putting their IT systems, some of which are monolithic and have grown over decades, to the test. Some companies have already decided to replace their IT systems, or are currently planning corresponding projects.

From Keylane’s perspective, there are several ways to modernise a core system:

- In-house developments are characterised by the fact that the scope of services can be individually designed. However, this individuality also entails risks, so care must be taken to ensure that agility and compatibility are guaranteed in these internally developed systems, so as not to create a cost trap, because in-house developments are usually extremely time-consuming and cost-intensive. Furthermore, knowledge management must be established and internal software development and support must be ensured to guarantee independence.

- Standard software is significantly more cost-effective compared to the costs of in-house development, since the individual requirements are reduced to a minimum. Furthermore, the compatibility of standard software solutions with other systems, such as interfaces for data exchange, or with solutions from third-party system providers and service providers that support the respective process, is already available, or can be connected quickly and easily as eco-partners through corresponding plug-in layers. Insurance companies benefit from the regular maintenance by the software provider and the constant developments, which take into account and map the process-related and regulatory particularities of the insurance market. Ideally, the standard software solution also functions as a platform that allows product providers and consumers to be brought together, and thereby linked in an ecosystem.

Keylane tilts the triangle

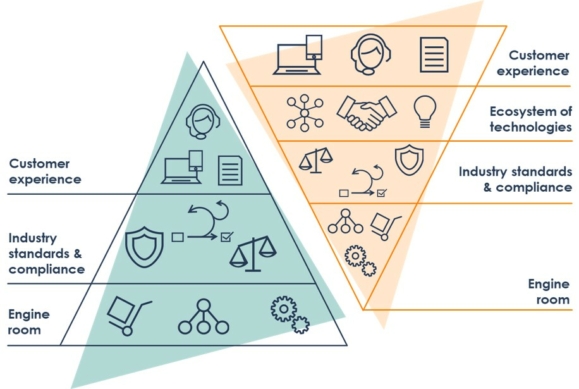

The Keylane Tilt the Triangle concept is about empowering the industry through technology by establishing a strong digital foundation that meets market changes, such as increasing customer demands, compliance and industry standards – and at the same time ensures speed to market and efficient business processes.

With a standardised approach of SaaS and high scalability, Keylane goes above and beyond to support insurance companies, enabling insurers to focus on offering a superior service to their insurance customers and business partners.

Interested to take our SaaS solutions for a free test drive? Sign up for a demo here.