Seizing digital transformation for sustainable growth

The life and pension industry is currently undergoing a profound digital transformation. It is no longer sufficient for pension providers to ensure customers a good return. Customers increasingly expect their pension provider to act and invest their savings sustainably and ethically, as well as profitably. Customers desire fast, easy, and excellent customer service, along with self-service options, which demand continuous digital enhancement. This confluence of factors creates a challenging balance for the life and pension providers’ long-term IT development.

To ensure the sustainability of providers and manage the substantial costs involved, the adoption of modern and robust IT systems has become a prerequisite. These systems not only enable operational viability but also contribute significantly to overall costs.

Seizing the potential

Simultaneously, process automation is offering a multitude of growth opportunities. This automation enhances productivity and customer satisfaction while aligning with regulatory requirements. To tap into these advantages, it is imperative to reshape the often fragmented system landscape characterised by isolated components. This transformation, which entails replacing these disjointed systems, presents both opportunities and risks for life and pension providers, necessitating strategic investments. The flexibility and scalability of IT systems are critical foundations for the providers’ existence, making the selection process a critical undertaking.

In the wake of front-end digitalisation, the adaptation of inflexible back-end systems emerges as the next transformative wave. Outdated back-end structures could potentially place providers at a disadvantage in a rapidly evolving competitive landscape. These legacy systems struggle to accommodate the product-specific, customer-specific, and regulatory demands of this new environment.

Modernising core systems

To confront these challenges, an increasing number of life and pension providers are evaluating their core IT systems. Many of these systems are monolithic and have developed over several decades. From Keylane’s perspective, there are several ways to modernise a core system:

- In-house developments are marked by their ability to be tailored to specific service scopes. Nonetheless, this customisation introduces risks that warrant careful consideration. It’s vital to ensure that agility and compatibility are maintained in these internally crafted systems, avoiding the potential for cost pitfalls, given that in-house developments often demand substantial time and resources. Additionally, effective knowledge management is essential, alongside the establishment of internal software development and support mechanisms to ensure sustained independence.

- Standard industry software offers significant cost-effectiveness in comparison to in-house development, as it minimises individual requirements. Moreover, standard software solutions seamlessly integrate with various systems, including interfaces for data exchange and third-party solutions. These integrations can be swiftly established through eco-partnerships using plug-in layers. Life and pension providers reap advantages from consistent software maintenance and ongoing developments, which consider and address the industry’s process-related and regulatory intricacies. Ideally, the standard software solution also serves as a platform that facilitates the convergence of product providers and customers, creating an interconnected ecosystem.

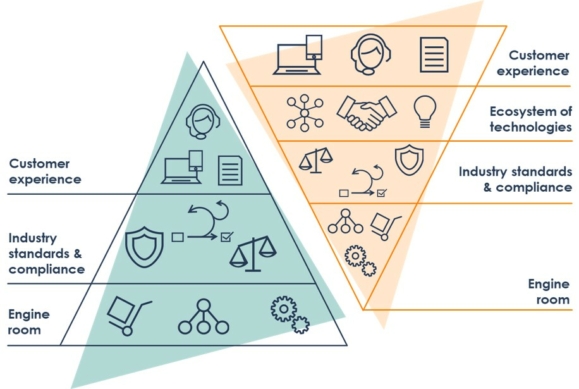

Tilt the Triangle – empowering through technology

The Keylane Tilt the Triangle concept empowers the life and pension industry through technology by establishing a strong digital foundation, that meets market changes such as increasing customer demands, compliance requirements, and industry standards. Simultaneously, this strategy ensures speed to market and streamlined business processes.

Through a standardised Software-as-a-Service (SaaS) approach and exceptional scalability, Keylane extends its support to life and pension providers, enabling them to channel their efforts into delivering unparalleled service to both their customers and business partners.

Curious to explore further?

If you’re interested in exploring our SaaS platform, we invite you to experience them first-hand. Sign up for a demo to witness how Keylane’s innovative solutions can elevate your operations and customer interactions.