Individualised insurance pricing in a subscription economy

Against current insurance pricing trends, insurance companies still apply standard, non-individualised pricing to embedded insurances as the go to-pricing strategy, even though those embedded insurance often have recurring customers.

Embedded insurance is nothing new. It has been around in the P&C insurance industry for a while now. However, until a few years ago, it was primarily used to provide insurances in one-off transactions, such as buying a flight ticket with a combined cancellation insurance, or hiring a car and getting an included all-risk insurance. Over the last few years, the market share of embedded insurances has seen a tremendous growth and will undoubtedly continue to grow larger in the years to come.

Embedded insurance is nothing new. It has been around in the P&C insurance industry for a while now. However, until a few years ago, it was primarily used to provide insurances in one-off transactions, such as buying a flight ticket with a combined cancellation insurance, or hiring a car and getting an included all-risk insurance. Over the last few years, the market share of embedded insurances has seen a tremendous growth and will undoubtedly continue to grow larger in the years to come.

How does this relate to the subscription economy?

There is a growing trend towards subscription over full ownership. Especially in the demographic of young professionals (30s or below) whom are longer inclined to buy expensive items such as cars, bikes or even property. Instead, they prefer to pay all-in-one, renewable subscription fees to gain access to use such items. And, since we are talking about the popularity of all-in-one offerings, this should also include insurances.

There is a growing trend towards subscription over full ownership. Especially in the demographic of young professionals (30s or below) whom are longer inclined to buy expensive items such as cars, bikes or even property. Instead, they prefer to pay all-in-one, renewable subscription fees to gain access to use such items. And, since we are talking about the popularity of all-in-one offerings, this should also include insurances.

As an example, consider the following use case: a city-based rental company renting out electric scooters per hour (or maybe even per minute). You can pick up a scooter from anywhere in that city by simply scanning a QR code on the scooter, which will automatically unlock it for immediate use. Once you have arrived at your destination, you simply scan the code again and the scooter self-locks. If you want to rent such a scooter, you only need to register your details with that company and, in most cases, download the corresponding company app. Furthermore, whenever you rent such a scooter, you are automatically insured for accidents.

From one-off standard pricing to recurring individualised pricing

With embedded insurance traditionally being part of a one-off transaction, insurers have had little choice other than to use a standardised pricing methodology for all buyers. As a result, the insurance premium was often a simple function of X euros by X time rented.

With a recurring customer base coupled with an increase in available data about them, insurance companies could start pricing embedded insurances in a more individualised manner. Going back to our example of the electric scooter, when that scooter has a telematics system onboard, driving behaviour can be analysed and combined with accurate knowledge about who has rented the scooter, such that the insurance company suddenly has greater insights into the risk profile of the insured person.

How to support this functionality

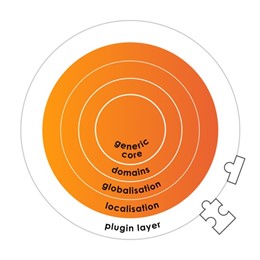

The key to supporting the kind of scenario as detailed above, is in having a core system which is easy to extend and connect to outside systems, and which also lets you define the insurance products in a completely flexibility and inherently adaptable manner.

Keylane’s Axon platform

Axon is Keylane’s all-in-one SaaS administration platform empowering strong partnerships between Property & Casualty insurance companies and their business partners. With a plugin architecture you can easily extend, Axon’s functionality enables you to connect to any other platform and exchange data, and our low-code product configurator supports the ability to define insurance products that were previously out of reach.